us capital gains tax news

Stock at 20 per share and sold them more than a. Yield from a certain investment.

Need To Report Cryptocurrency On Your Taxes Here S How To Use Form 8949 To Do It Bankrate

Any gains or dividends received on common stock.

. Long-term capital gains tax rates typically apply if you owned the asset for more than a year. Your money adviser As Home Sale Prices Surge a Tax Bill May Follow. Passed by the Senate in March in another narrow vote Engrossed Substitute Senate Bill 5096 would impose a new 7 tax on certain capital gains income including profits from selling long-term assets.

2021 Federal Income Tax Brackets. Combined with a 38 Medicare surtax the richest Americans would pay a 434 top rate on capital gains. The plan released by the House Ways and Means Committee Monday sets the top rate for taxing capital gains -- money earned from the sale of assets such as stocks or property -- at 25 up from 20.

2021 federal capital gains tax rates The tables below show marginal tax rates. That means you could pay up to 37 income tax depending on your federal income tax bracket. The Biden administration recently released plans to increase the top capital gains tax rate for people earning over a million dollars a year to.

It would apply to taxpayers with income of more than 1 million. Capital Gain Tax Rates The tax rate on most net capital gain is no higher than 15 for most individuals. This feed updates continuously 247 so check back regularly.

Short-term capital assets and long-term capital assets. Capital gains tax rates on most assets held for a. Capital gains tax rates were significantly increased in the 1969 and 1976 Tax Reform Acts.

The current long-term capital gains tax rates for single filers are 0 for taxable incomes up to 40400 15 for incomes of between 40401 and 445850 and 20 for incomes of 445851 or more. Single sellers can exclude 250000 from their taxable profit and married sellers 500000. In 1978 Congress eliminated the minimum tax on excluded gains and increased the exclusion to 60 reducing the maximum rate to 28.

Some or all net capital gain may be taxed at 0 if your taxable income is less than or equal to 40400 for single or 80800 for married filing jointly or qualifying widow er. Heres how the House Democrats plan could push that rate to 318 for some investors. In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for longer than a year.

Latest news headlines analysis photos and videos on Capital Gains. Capital profits tax is a tax that is levied on earnings made from the promotion of capital assets. Generally speaking capital gains taxes are paid on the sale or profits made on a set asset or investment.

House Democrats on Monday proposed raising the top tax rate on capital gains and qualified dividends to 288 one of several tax reforms aimed at wealthy Americans to help fund a 35 trillion. Although taxes may be due in 2022 a married couple filing jointly can recognize up to 83350 in capital gains and pay 0 in taxes if they have no other income. Capital Gains Tax News.

Capital gains tax CGT is not a separate tax but forms part of income tax. In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for longer than a year. Income received from a rental property.

Capital Gains Tax News. Capital gains taxes apply to the following. Although taxes may be due in 2022 a married couple filing jointly can recognize up to 83350 in capital gains and pay 0 in taxes if.

President Joe Biden. Many people qualify for a 0 tax rate. Individuals earning 200000 a.

This means that different portions of your taxable income. Therefore the top federal tax rate on long-term capital gains is 238. In the US short-term capital gains are taxed as ordinary income.

The 1981 tax rate reductions further reduced capital gains rates to a maximum of 20. To be fair to the worried investors the proposed rates look very different from the current ones with a top federal capital gains tax of only 20. In the United States capital gains tax rates can vary depending on the.

Ad Tax-Smart Investing Can Help You Keep More of What You Earn. Latest news on Capital Gains Tax in the United States where individuals and corporations pay US federal income tax on the net total of all their capital gains. Unlike the long-term capital gains tax rate there is no 0.

Currently the top federal capital gains rate is 20 for people earning more than 400000.

2021 Capital Gains Tax Rates By State

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

How Is Cryptocurrency Taxed Forbes Advisor

Capital Gains On Home Sales What Is Capital Gains Tax On Real Estate Guaranteed Rate

Capital Gains Tax Advice News Features Tips Kiplinger

Joe Biden Tax Plans Proposals Tax Foundation

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Capital Gains Tax Rate In California 2022 Long Short Term Seeking Alpha

Capital Gains Tax What Is It When Do You Pay It

How To Save Capital Gain Tax On Sale Of Residential Property

Biden Will Seek Tax Increase On Rich To Fund Child Care And Education The New York Times

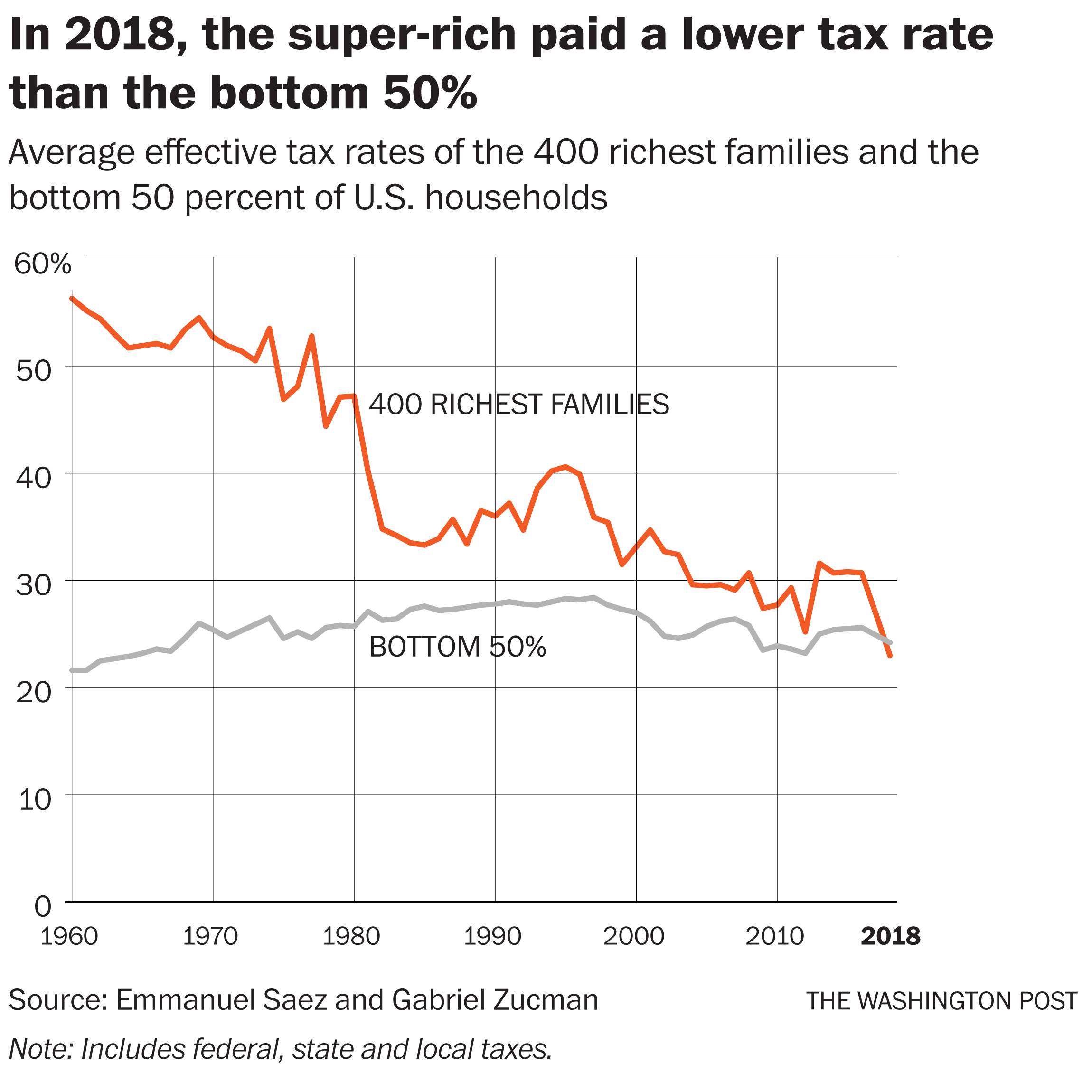

For The First Time In History U S Billionaires Paid A Lower Tax Rate Than The Working Class The Washington Post

The Top Tax Rate Has Been Cut Six Times Since 1980 Usually With Democrats Help The Washington Post

Biden Budget Tax Plan Raises Tax Rates To Highest In Developed World

Here S How Much You Can Make And Still Pay 0 In Capital Gains Taxes

Here S How Much You Can Make And Still Pay 0 In Capital Gains Taxes

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

Dr Rick Martin State S New Tax On Surgery Centers Threatens Care Ortho Spine News Income Tax Capital Gains Tax Tax Accountant