reverse tax calculator australia

Show tax rate table. Updated with 2022-2023 ATO Tax rates.

Tax Refund Calculator 2020 2021 Tax Return Estimator Industry Super

Simple steps to lodge your 2022 tax return online.

. Calculate Australian tax figures fast. Call 1300 829 863 Tax Today Australias leading Tax Agents that provide Instant Tax Refunds. As announced in the 202223 federal Budget the low and middle income tax offset has been increased by 420 for the 2021-22 income year.

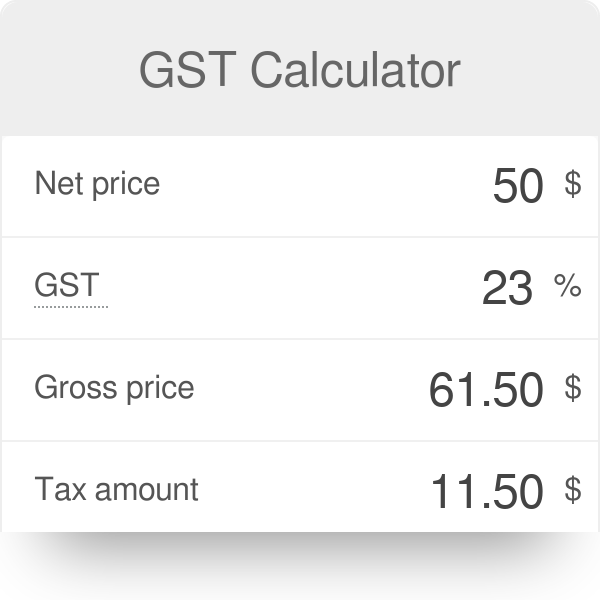

This up to date tax calculator applies to the last financial year ending on 30 June. 500 is GST exclusive value. JAWs Oz Tax Calculator for the Current Financial Year.

Calculate tax figures in Australia for the financial year ending in 2020. CALCULATE YOUR REFUND NOW. 500 01 50 GST amount.

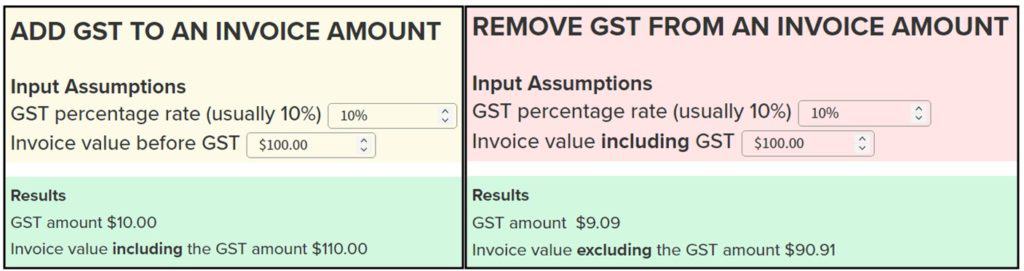

It can be used for the 201314 to 202122 income years. Amount without sales tax QST rate QST amount. To figure out how much GST was included in the price you have to divide the price by 11 1101110.

Tax planning tax advice. Current HST GST and PST rates table of 2022. Enter net earnings as weekly or annual.

The current version of the Excel spreadsheet xlsx has separate tabs for tax years 2018 to 2024-25. The reverse tax calculator calculate net earnings to gross earnings. Tax rate for all canadian remain the same as in 2017.

Please enter your salary into the Annual Salary field and click Calculate. To calculate Australian GST at 10 rate is very easy. Show me tax rates for.

How much Australian income tax you should be paying. Adding 10 to the price is relatively easy just multiply the amount by 11 reverse GST calculations are quite tricky. We have just released our Reverse Tax Calculator which calculate net after tax earnings to gross before tax earnings.

Current financial year 2020 2019 2018 2017 2016 2015 2014 2013 2012 2011 2010 2009. This free to download Excel tax calculator has been updated for the 2021-22 and later years 2022-23 2022-24 and 2024-25 and includes the March 2022 Budget increase of 420 to the Lower and Middle Income Tax Offset for the 2021-22 year. Calculate your tax return quickly with our easy to use tax calculator.

This calculator can also be used as an Australian tax return calculator. On March 23 2017 the Saskatchewan PST as raised from 5 to 6. Your marginal tax rate.

Simply enter any one field press the calculate button and all the other fields will be shown. Lodging a tax return. Find tax tips to help you maximise your tax return each year.

The reverse sales tax calculator exactly as you see it above is 100 free for you to use. Simply enter any one field press the calculate button and all the other fields will be derived. Information you need for this calculator.

When you cant use the. Instantly calculate your tax return refund by inputting your numbers into our Australian Tax Return Refund Calculator. Simply enter your numbers and our tax calculator will do the maths for you.

Australian income is levied at progressive tax rates. Before you use this calculator. This easy-to-use calculator can help you figure out instantly how much your gross pay is based on your net pay.

How much Australian income tax should you be paying. If your taxable income is less than 126000 you will get some or all of the low and middle income tax offset. Price before Tax Total Price with Tax - Sales Tax.

The base amount for the 2021-22 income year has increased to 675 and the full amount is 1500. Includes 2 medicare levy and low income tax offset. Amount without sales tax GST rate GST amount.

Individuals on incomes below 18200 are also entitled to the Low and Middle Income Tax Offset LMITO. Sacrificing part of your salary can reduce your tax. The rates in the above tables do not include the Medicare levy of 2.

So check your payslip employer is paying you the correct amount of super. Select the frequency weekly or annual 3. For salary and wage payments made on or after 1 July 2022 the new superannuation guarantee contribution rate of 105 will apply.

Reverse Sales Tax Calculations. Note that it does not take into account any tax rebates or tax offsets you may be entitled to. If you want to customize the colors size and more to better fit your site then pricing starts at just 2999 for a one time purchase.

This should be for your current tax return that is due. The Reverse Tax Calculator is part of the. Just multiple your GST exclusive amount by 01.

Up next in Income tax. This financial year started on 1 July 2021 and ends on 30 June 2022. To get GST inclusive amount multiply GST exclusive value by 11.

Then find out how you can pay less tax. The gross pay estimator will give you an estimate of your gross pay based on your net pay for a particular pay period. Prepare for a quick and efficient tax return experience with our checklist.

Here is how the total is calculated before sales tax. Search our frequently asked questions to find. Business tax.

JAWs Australian tax calculator with reverse lookup for end of financial year 2020. See the article. 500 is GST exclusive value.

The calculator takes into account Medicare Levy and the Low Income Tax Rebate but does not take into account other rebates such as the Family Tax Benefits Social Security Rebates. This calculation is used on a regular basis by Personal Injury and Family Law lawyers. You can use tax rates from 2013 to 2002 and specify either weekly or annual net after Tax earnings.

Sales Tax Rate Sales Tax Percent 100. A pay period can be weekly fortnightly or monthly. Be mindful it is only an estimate but does calculate the same way as the ATO works out your refund.

What your take home salary will be when tax and the Medicare levy are removed. In addition to income tax there are additional levies such as Medicare. Where Sales Tax is the dollar amount of sales tax paid Sales Tax Percent is the state sales tax as a percentage and Sales Tax Rate is the state sales tax as a decimal for calculations.

Here are the Australian income tax rates and brackets for the 202122 financial year for Australian residents according to the Australian Taxation Office ATO. Amount with sales tax 1 GST and QST rate combined100 or 114975 Amount without sales tax. Tax bracket start at 0 known as the tax-free rate and increases progressively up to 45 for incomes over 180000.

Helps you work out.

Reverse Tax Calculator Net To Gross

Income Tax Calculating Formula In Excel Javatpoint

Sales Tax Decalculator Formula To Get Pre Tax Price From Total Price

Reverse Mortgage Calculator Reverse Mortgage Pay Off Mortgage Early Mortgage Calculator

Salary Formula Calculate Salary Calculator Excel Template

![]()

Free Income Tax Calculators Australia Ashburn Tax Accountants

Salary Formula Calculate Salary Calculator Excel Template

Ugru Crm Vs Salesforce Vs Wealthbox Vs Redtail Vs Zoho For Mobile Email Calendar Workflows And Tasks Crm Financial Planner Financial Planning Organization

Aged Care Finance Seniors First Retirement Finance Services Mortgage Brokers Reverse Mortgage Mortgage Loans

How To Correctly Calculate Gst Figures Kiwi Tax

Pin On Australia Property Calculators

Melbourne Victoria Panorama Wallpaper Hd City 4k Wallpapers Images Photos And Background Wallpapers Den Mortgage Brokers Melbourne City Wallpaper

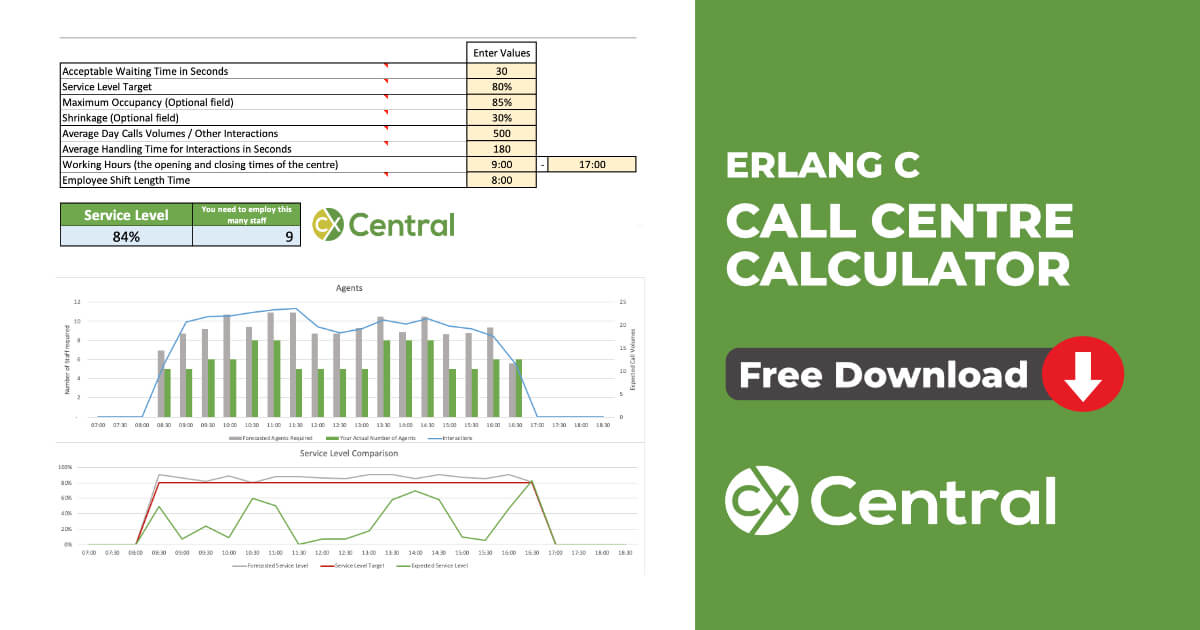

Free Call Centre Calculator To Forecast Number Of Agents Service Levels

Reserve Ratio Formula Calculator Example With Excel Template

Gst Calculator Australia Atotaxrates Info

Commercial Property Lease Or Buy Analysis Calculator Investment Analysis Commercial Property Analysis